Hourly take home calculator

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. All taxpayers in Utah pay a 495 state income tax rate regardless of filing.

Salary To Hourly Salary Converter Salary Hour Calculators

Within United States employees must be paid no less than the minimum wage as specified by the Federal and the local governments.

. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying. Like federal income taxes Minnesota income taxes are pay-as-you-go. Use ADPs Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

First enter your current payroll information and deductions. Start by entering your current payroll information and any relevant deductions. Ad Read reviews on the premier Calculator Tools in the industry.

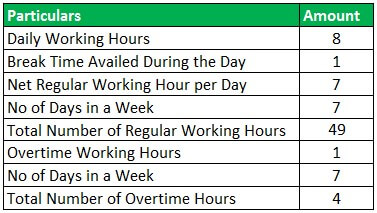

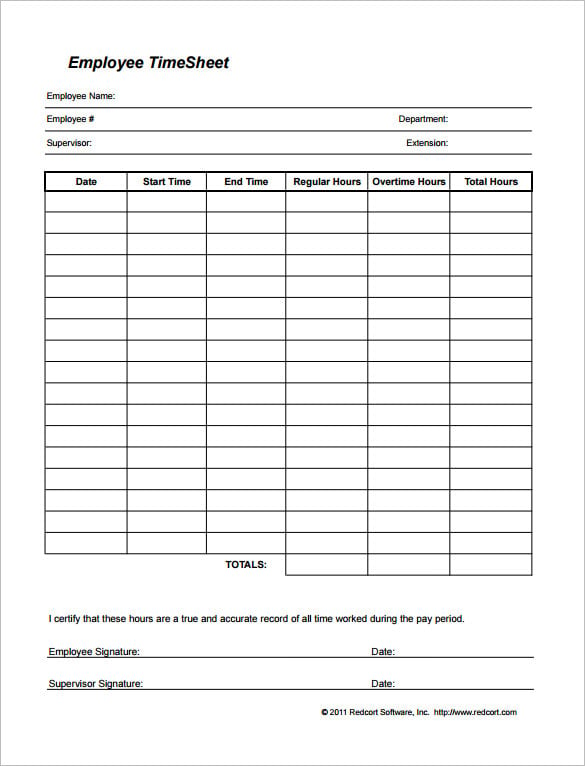

Hourly Calculator Virginia Virginia Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. It should not be relied upon to calculate exact taxes payroll or other financial data. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

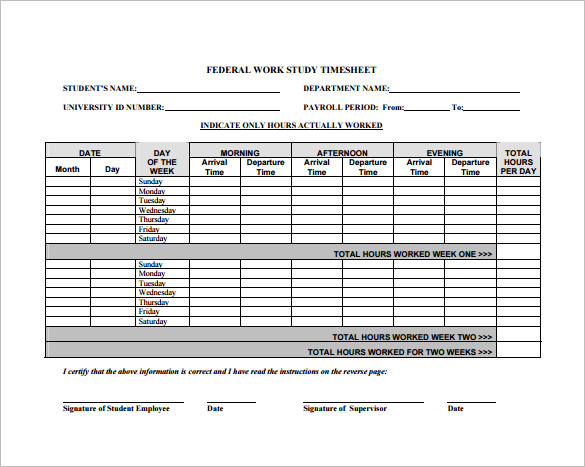

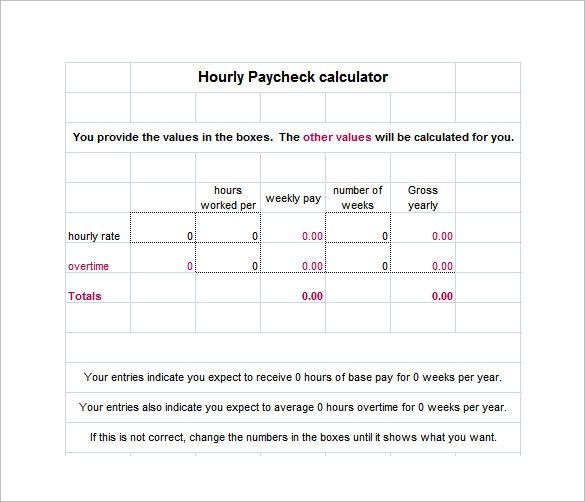

Enter the number of hours and the rate at which you will get paid. There are two options in case you have two different overtime rates. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

If you earn over 200000 youll also pay a 09 Medicare surtax. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Important Note on Calculator.

This calculator is intended for use by US. Money comes out of each of your paychecks throughout the year rather than you getting one giant tax bill in the spring. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees.

Switch to salary Select Your State. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Important note on the salary paycheck calculator.

In Minnesota your employer will deduct money to put toward your state income taxes. Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

This Virginia hourly paycheck calculator is perfect for those who are paid on an hourly basis. These calculators are not intended to provide tax or legal. Then multiply that number by the total number of weeks in a year 52.

To try it out enter the workers details in the payroll calculator and select the hourly pay rate option. Find Calculate my take home pay. Use ADPs Texas Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Your employer withholds a 62 Social Security tax and a 145 Medicare tax from your earnings after each pay period. In the Weekly hours field enter the number of hours you do each week excluding any overtime. It can also be used to help fill steps 3 and 4 of a W-4 form.

The second algorithm of this hourly wage calculator uses the following equations. This calculator is intended for use by US. The hourly wage calculator accurately estimates net pay sometimes called take-home pay after overtime bonuses withholdings and deductions.

If you know your tax code you can enter it or else leave it blank. - A Annual salary HW LHD 52 weeks in a year - B Monthly salary A 12 - C Weekly salary HW LHD What is minimum wage. Utah has a very simple income tax system with just a single flat rate.

Search For Calculate my take home pay With us. Our salary calculator indicates that on a 72414 salary gross income of 72414 per year you receive take home pay of 49945 a net wage of 49945. Take Home Salary Calculator is an application which will calculate your take home salary from your annual CTC amount.

It can also be used to help fill steps 3 and 4 of a W-4 form. The calculator on this page is provided through the ADP. For example for 5 hours a month at time and a half enter 5 15.

Enter your info to see your take home pay. Ohio has a progressive income tax system with six tax brackets. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15.

5 hours double time would be 5 2. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. When calculating your take-home pay the first thing to come out of your earnings are FICA taxes for Social Security and Medicare.

Free Online Houly Paycheck Calculator for 2022 Use the following calculation tool to estimate your paycheck based on the stated hourly wages. To keep the calculations simple overtime rates are based on a normal week of 375 hours. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Overview of Utah Taxes. Next divide this number from the annual salary. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

This federal hourly paycheck. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. How do I calculate hourly rate.

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Hourly wage 2500 Daily wage 20000 Scenario 1. Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages.

Then enter the hours you expect. In the Weekly hours field enter the number of hours you do each week excluding any overtime. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

See the Calculator Tools your competitors are already using - Start Now. Then enter the estimated total number of hours you expect to work and how much you are paid per hour. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

Then enter the number of hours worked and the employees hourly rate.

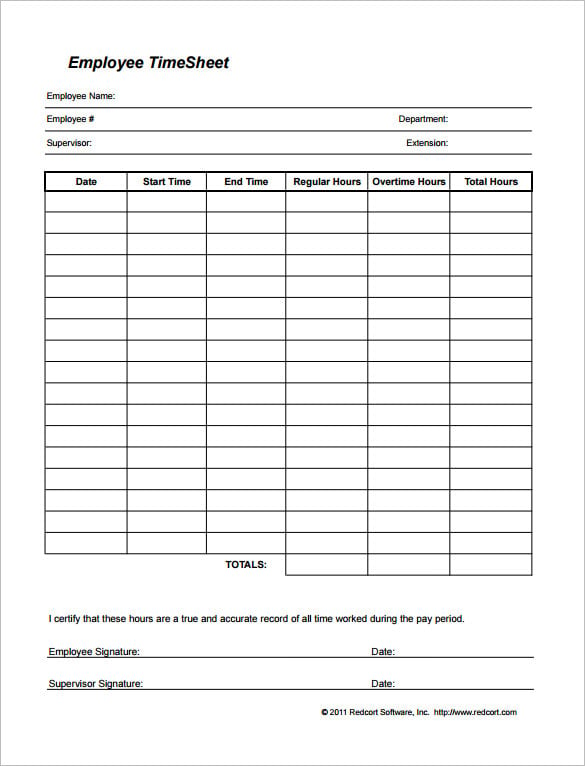

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary Calculator

Hourly Paycheck Calculator Step By Step With Examples

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Hourly To Salary Calculator Convert Your Wages Indeed Com

Paycheck Calculator Take Home Pay Calculator

How To Calculate Payroll For Hourly Employees Sling

8 Hourly Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly Rate Calculator

Gross Pay And Net Pay What S The Difference Paycheckcity

3 Ways To Calculate Your Hourly Rate Wikihow

Hourly Paycheck Calculator Step By Step With Examples

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

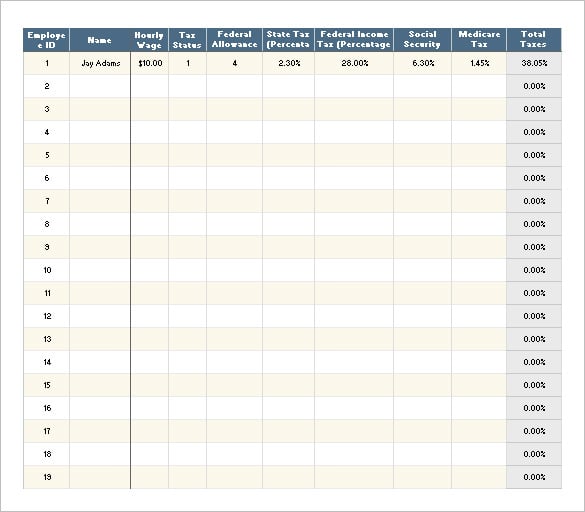

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Paycheck Calculator Take Home Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Salary What Is My Annual Income